Key Qualifications For Protection Under The Fair Credit Reporting Act (Fcra)

What is the Fair Credit Reporting Act? The Fair Credit Reporting Act (FCRA) stands as a cornerstone of consumer protection in the United States, aiming to ensure fairness, accuracy, and privacy of information in consumer credit reports. Enacted in 1970 and subsequently amended, the FCRA outlines specific criteria that qualify for protection. Understanding these criteria is crucial for both consumers and businesses to navigate the complex landscape of credit reporting. In this article, we delve into the key qualifications for protection under the FCRA.

Accuracy and Completeness of Information:

One of the fundamental provisions of the FCRA is the requirement for consumer reporting agencies (CRAs) to maintain accurate and complete information in consumer reports. Consumers have the right to dispute any inaccuracies or incomplete information in their credit reports. CRAs must investigate these disputes and correct any errors within a reasonable timeframe, ensuring that consumers’ creditworthiness is fairly represented.

Consent for Credit Inquiries:

Fair Credit Reporting Act lawyer, Under the FCRA, creditors, and lenders must obtain the consumer’s consent before accessing their credit report for purposes such as evaluating credit applications or making lending decisions. This consent requirement helps safeguard consumers’ privacy and ensures that their credit information is not accessed without their knowledge or authorization.

Adverse Action Notifications:

When an adverse action, such as a denial of credit or employment, is taken based on information obtained from a consumer report, the FCRA mandates that the consumer must be notified. This notification must include specific details, such as the name and contact information of the CRA that provided the report, enabling consumers to review the information and take appropriate action if necessary.

Limited Use of Medical Information:

The FCRA imposes restrictions on the use of medical information in consumer reports. Medical information can only be disclosed with the consumer’s consent or for specific permissible purposes, such as underwriting insurance or processing certain government benefits. This provision protects consumers’ sensitive health information from being misused or discriminated against in credit decisions.

Identity Theft Protection:

In response to the growing threat of identity theft, the Florida Fair Credit Reporting Act Attorney includes provisions aimed at combating this crime and assisting identity theft victims. Consumers have the right to place fraud alerts on their credit reports, dispute fraudulent information, and request identity theft reports from CRAs. These measures help consumers detect and mitigate the adverse effects of identity theft on their credit profiles.

Disposal of Consumer Information:

To prevent unauthorized access to sensitive consumer information, the FCRA requires businesses to properly dispose of records containing such information. This includes shredding documents, erasing electronic files, and taking other appropriate measures to ensure that consumer data is securely disposed of when no longer needed. Failure to comply with these requirements can lead to penalties and legal consequences.

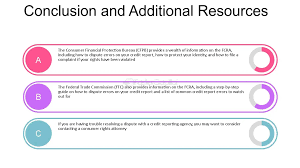

Contact Our Florida FCRA Lawyer

Seek Help from a Florida FCRA Lawyer Law Offices of Jibrael S. Hindi to understand your rights.