The Role of Estate Planning in Protecting Business Interests

In the dynamic landscape of business ownership, safeguarding your assets and interests is paramount. However, many entrepreneurs overlook the importance of integrating their business endeavors into their estate planning strategy. Whether you’re a sole proprietor, a partner in a small firm, or a shareholder in a larger corporation, incorporating your business interests into your estate plan can provide invaluable protection and continuity for your legacy. Let’s delve into how an estate plan can fortify your business interests and ensure a seamless transition for future generations.

Contents

Understanding the Role of Estate Planning

Estate planning isn’t just about drafting a will or assigning beneficiaries. It’s a comprehensive strategy designed to manage your assets during your lifetime and efficiently transfer them upon your death. While it commonly involves personal assets like real estate, investments, and valuables, integrating your business holdings into your estate plan is equally essential. Hire a Tampa estate planning attorney.

Protecting Your Business from Uncertainties

Entrepreneurs often dedicate significant time and resources to nurturing their businesses, making it imperative to shield these assets from potential risks. Incorporating your business into your estate plan can help mitigate various uncertainties, including:

Business Continuity: A well-structured estate plan can outline succession plans and designate successors, ensuring the seamless continuation of your business operations in the event of your incapacitation or demise.

Debt and Liability Management: By strategically organizing your business assets within your estate plan, you can mitigate the risk of creditors seizing control of your business or disrupting its operations to settle outstanding debts.

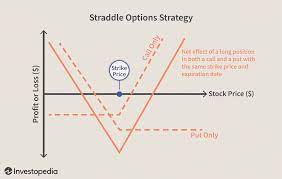

Tax Optimization: Estate planning offers opportunities to minimize tax liabilities, both during your lifetime and upon the transfer of your business assets to heirs. Techniques such as family limited partnerships or trusts can help mitigate estate taxes and preserve more of your business’s value.

Key Components of Business-Oriented Estate Planning

Integrating your business interests into your estate plan involves several crucial components:

Business Succession Plan: Clearly outline your wishes regarding the transfer of ownership and management responsibilities. Whether passing the business to family members, or key employees or selling to an external party, a well-defined succession plan ensures a smooth transition and preserves the integrity of your business.

Buy-Sell Agreements: Establishing buy-sell agreements among business partners or shareholders can provide a predetermined framework for the transfer of ownership interests in the event of a partner’s death or departure. These agreements help maintain stability within the business and protect the interests of all parties involved.

Asset Protection Strategies: Implementing asset protection strategies within your estate plan can safeguard your business assets from potential creditors or legal claims. Trust structures, such as irrevocable trusts or asset protection trusts, offer a layer of insulation against external threats while allowing you to retain control and benefit from the assets during your lifetime.

Life Insurance Policies: Life insurance can be a valuable tool to provide liquidity for your estate and ensure the continuity of your business operations. Proceeds from life insurance policies can be used to fund buy-sell agreements, settle outstanding debts, or provide financial support for your family and business partners.

Regular Review and Adaptation

As your business evolves and your circumstances change, it’s essential to periodically review and update your estate plan accordingly. Changes in tax laws, business structures, or family dynamics may necessitate adjustments to ensure that your plan remains aligned with your objectives and provides adequate protection for your business interests.

Contact our Largo estate planning lawyers today

If you want to talk about your business interests more deeply contact our largo estate planning lawyer at Mickey Keenan, PA. Our attorneys take the time to understand your concerns and desires, explaining which options might be best to include in your estate plan.